Cost behavior must be considered to estimate how profits are affected by changes in sales prices, sales volume, unit variable costs, total fixed costs, and the mix of products sold. The contribution margin income statement classifies costs on the basis of cost behavior. For this reason, it is an essential tool for cost volume profit analysis. The contribution margin income statement is covered in detail in Chapter 1.

Get Any Financial Question Answered

Basically, it shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. So, for a business to be profitable, the contribution margin must exceed total fixed costs. CVP analysis is used to determine whether there is an economic justification for a product to be manufactured. The decision maker could then compare the product’s sales projections to the target sales volume to see if it is worth manufacturing. The contribution margin is the difference between total sales and total variable costs.

Overlooking the impact of price changes – The Most Common Errors That Can Arise When Analyzing the Results of CVP

In tandem with these assumptions about the behavior of costs, cost volume profit analysis also makes several assumptions about production and sales. The crucial assumption is that the volume of sales equals the volume of production. This implies that there will be no change in the level of stock held by the business, i.e., there is neither accumulation nor depletion of finished goods inventories. These costs must be factored into the CVP analysis since they also impact the overall profitability. Neglecting the effect of variable costs can lead to overestimating profits or underestimating costs.

Operating Profit Margin: Understanding Corporate Earnings Power

To illustrate the concept of the sales price in CVP analysis, let’s consider the example of a company that produces and sells widgets. The company has a fixed cost of $10,000 per month, and its variable cost is $5 per widget. If the store sells $20,000 worth of merchandise in a month, the variable costs, such as the cost of goods sold, maybe $10,000. The contribution margin, which is the difference between the sales revenue and the variable costs, would be $10,000. To illustrate the concept of identifying fixed costs, let’s consider the example of a retail store.

It provides important information about how changes in costs and other factors will affect profitability as well as helps managers identify breakeven points for budgeting purposes. Cost Volume Profit (CVP) Analysis is a technique used to determine the volume of activity or sales required for an organization to break even or make a profit. It looks at the relationship between costs, sales volume, and profits over various levels of activity.

Cost Volume Profit Analysis (CVP) Explained

As such, businesses that offer different products must calculate a weighted average contribution margin to determine the breakeven point. CVP analysis empowers managers to make strategic decisions regarding their business expansion. By analyzing the company’s breakeven point and profit margins, managers can determine the product mix, sales volume, and pricing strategy that will maximize profitability. In this example, identifying fixed costs is essential for understanding the store’s profitability and cash flow.

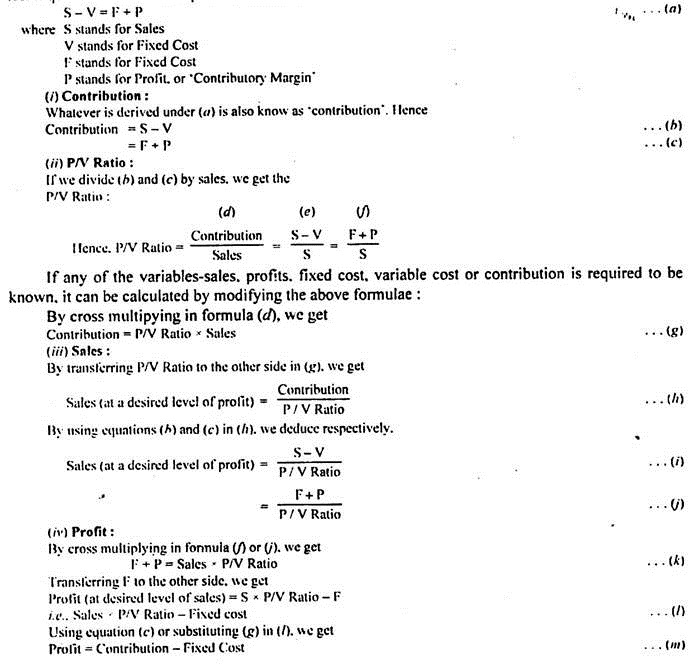

Total variable costs are found by multiplying unit variable cost (UVC) by total quantity (Q). Any excess of total revenue over total costs will give rise to profit (P). By putting this information into a simple equation, we come up with a method of answering CVP type questions.

You can also calculate your margin of safety to determine how far your sales can drop and you still break even. In conjunction with other types of financial analysis, leaders use this to set short-term goals that will be used to achieve operating and profitability targets. CVP Analysis helps them to BEP Formula for different sales volume and cost structures.

- The total amount for sales dollars, variable costs, and contribution margin are also changed.

- It represents the amount available from each unit of sale to cover fixed costs and generate profits.

- This means that the company incurs $5 in variable costs for every widget sold.

- The contribution margin is the amount left over after subtracting variable costs from the revenue.

The store can make informed decisions about pricing, product mix, and resource allocation by understanding the fixed costs. The store can also use fixed costs for budgeting and forecasting to information for furloughed workers ensure that it can cover its expenses and generate a profit. It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs.

Since total contribution margin is changed, net operating income will also change. Cost volume profit analysis can be used to analyze the effect on net operating income from changes in variable costs, also considered a change in cost structure. A change in variable cost is a per unit change, so it affects the per unit amounts on the contribution margin income statement. When variable cost changes, per unit sales price remains the same, but the per unit contribution margin changes. The total amount for sales dollars, variable costs, and contribution margin are also changed. Cost volume profit analysis provides valuable insights into the correlation between total sales and net income.

Cost-volume-profit (CVP) analysis is an essential tool in managerial accounting used to determine a company’s breakeven point and profitability. However, common misconceptions about CVP often lead to misconstrued results, which could ultimately affect business decisions. Moreover, CVP analysis also helps managers assess the impact of changes in sales volume, costs, and other factors on financial performance.